Embrace Pet Insurance Review

This page contains affiliate links. We may earn money or products from the companies mentioned in this post through our independently chosen links, which earn us a commission. Learn More

Health coverage for your pet gives you peace of mind knowing that your pet will receive the care he needs when he needs it. Pet health insurance is a little different from health insurance for people, but the right plan could help you get back up to 90% of what you spend on a vet bill for covered services.

There are many pet insurance plans to choose from but Embrace is one of the top names in the industry. Embrace pet insurance offers “simply great pet insurance coverage” for accidents, illnesses, and testing. Read on to learn everything you need to know about the fine print on Embrace to decide if it’s the right option for you.

- Healthy Pet Deductible. Receive $50 off your annual deductible for healthy pets.

- Quick Payments. Pays claims within 10 and 15 business days.

- No Lifetime Limits. No annual limit on coverage per accident or illness.

- Optional Wellness Rewards. Additional reimbursement for routine vet care, grooming, and training.

- Enrollment Fee. Charges a $25 enrollment fee and $1 monthly transaction fee.

- Bilateral Injury Policy. Existing orthopedic injury on one side rules the other leg a pre-existing condition, not covered.

- Upper Age Limit. Accident and illness coverage only for pets up to 15 years.

- Waiting Periods. Required 14-day waiting period, 6 months on orthopedic care.

- Healthy Pet Deductible. Receive $50 off your annual deductible for healthy pets.

- Quick Payments. Pays claims within 10 and 15 business days.

- No Lifetime Limits. No annual limit on coverage per accident or illness.

- Optional Wellness Rewards. Additional reimbursement for routine vet care, grooming, and training.

- Enrollment Fee. Charges a $25 enrollment fee and $1 monthly transaction fee.

- Bilateral Injury Policy. Existing orthopedic injury on one side rules the other leg a pre-existing condition, not covered.

- Upper Age Limit. Accident and illness coverage only for pets up to 15 years.

- Waiting Periods. Required 14-day waiting period, 6 months on orthopedic care.

Quick Navigation

About Embrace Pet Insurance

Pets are more than just household companions – they’re members of the family. You love your pet and want him to live the happiest, healthiest life possible which means you want him to have the same access to healthcare you do. Pet health insurance provides coverage for pet parents like you to help offset the costs of preventive and emergency veterinary services.

Embrace pet insurance claims to be “more than just insurance.” When you sign up for Embrace pet insurance, you become part of the family as well.

One of the top names in the pet insurance industry, Embrace was founded in 2003 and has since won numerous awards including the 2019 International Service Excellence Award and The Plain Dealer’s Top Work Places six times. The company actually started as a pet insurance concept that won the 2003 Wharton Business Plan Competition and the first plan was sold October 10, 2006.

In 2012, Embrace partnered with American Modern Insurance Group to expand their coverage and has continued to craft coverage that meets the needs of pets and their parents while keeping things affordable. They started offering the Healthy Pet Deductible benefit in 2012 and launched their MyEmbrace online customer portal in 2015.

Today, Embrace is one of the most popular and well-reviewed pet insurance plans on the market. Read on to learn the basics about Embrace, their plans, and their coverage.

How Does Embrace Pet Insurance Work?

Pet insurance providers like Embrace typically offers coverage for unexpected accidents and illness including exam fees, diagnostic testing, surgery or hospitalization, and prescription medications, childinjuryfirm.com/tramadol-ultram. Preventive care usually isn’t covered, though many companies offer optional wellness plans or add-on coverage. Here are the details you need to know for Embrace pet insurance plans:

-

Pet Insurance Plans

Embrace offers what they call “nose-to-tail” pet insurance coverage. It is a simple but comprehensive pet insurance policy that reimburses up to 90% of your pet’s unexpected vet bills. You can personalize your policy as desired, but the following categories are generally covered:

- Accidents – This includes everything from broken bones to foreign body ingestion, including consultation fees and exam fees at any licensed veterinarian.

- Illnesses – Every plan includes coverage for any illness with no per-condition limitation.

- Dental Illness – Dental issues like periodontal disease, root canals, gingivitis, crowns, and extractions are covered at up to $1,000 per year.

- Breed-Specific/Genetic Conditions – All hereditary and genetic conditions are covered, including hip dysplasia, allergies, IVDD, and more.

- Cancer – One of the leading causes of expensive vet bills, all testing and treatment for cancer is covered under the comprehensive plan.

- Chronic Conditions – There are no limitations on coverage for chronic conditions like allergies, diabetes, and arthritis.

In addition to these general coverage areas, Embrace also covers exam fees (also known as consultation fees) for no additional cost. Emergency vets often charge $100 or more for these fees but Embrace covers the fee in all policies at no additional charge.

To delve a little deeper into what Embrace actually covers, here’s an overview of covered treatments:

- Prescription drugs

- Alternative therapies and rehabilitation (like acupuncture, hydrotherapy, and physiotherapy)

- Behavioral therapy

- Emergency veterinary care (including after-hour treatment centers)

- Specialist care (such as oncologists, internal medicine experts, etc.)

- Diagnostic testing for all covered conditions

- Hospitalization and surgery

- Prosthetics and mobility devices

All insurance plans have exclusions, including pet insurance. Embrace doesn’t cover routine veterinary care or pre-existing conditions, nor do they cover cosmetic procedures, breeding, or injury resulting from cruelty or neglect. For more info about pre-existing conditions, read about waiting periods below.

Here’s a quick review of the coverage Embrace pet insurance offers:

| Routine Vet Exam | Emergency Vet Visit | Specialty Vet Visit | Diagnostic Testing & Imaging | |||

| Veterinary Exams | X | X | X | |||

| Acupuncture | Chiropractic | Hydrotherapy | Physiotherapy | Therapeutic Laser Treatment | Behavioral Therapy | |

| Alternative Therapies | X | X | X | X | X | X |

| Biopsies | Urinalysis | Fecal Exams | Fine Needle Aspirates | |||

| Diagnostic Testing | X | X | X | X | ||

| Anesthesia | Exam Fees | Vet Time | Tech Time | Rehabilitation | Follow-Up | |

| Hospitalization and Surgery | X | X | X | X | X | X |

| Prosthetics & Mobility Devices | Prescription Drugs | Curable Conditions | Pre-Existing Conditions | Preventive Care | Genetic Disorders | |

| Others | X | X | X | X | ||

Though Embrace’s nose-to-tail plan doesn’t include routine veterinary care, you can purchase Wellness Rewards as an add-on to help cover routine veterinary care, training, and grooming costs. You can also purchase an accident-only plan for pets who exceed the maximum age limit for the comprehensive plan.

-

Pricing

What makes Embrace pet insurance unique is that they customize your pet’s plan according to his needs. Prices range from as low as $12.50 per month to over $75 per month, depending your pet’s age, breed, and health status. Your monthly premium will also change depending on the reimbursement level, annual deductible, and annual reimbursement limit you choose.

The best way to find out how much Embrace costs is to request a quote.

To give you an example of two different pets, we’ll use a 2-year-old mixed-breed male dog weighing 50 pounds.

Here’s the breakdown of several options:

| Reimbursement % | Annual Reimbursement Limit | Annual Deductible | Monthly Premium |

| 70% | $5,000 | $1,000 | $14.52 |

| 70% | $5,000 | $500 | $23.54 |

| 70% | $5,000 | $300 | $28.64 |

| 70% | $10,000 | $1,000 | $16.84 |

| 70% | $10,000 | $500 | $27.31 |

| 70% | $10,000 | $300 | $33.22 |

| 70% | $30,000 | $1,000 | $20.61 |

| 70% | $30,000 | $500 | $33.43 |

| 70% | $30,000 | $300 | $40.67 |

| Reimbursement % | Annual Reimbursement Limit | Annual Deductible | Monthly Premium |

| 80% | $5,000 | $1,000 | $16.33 |

| 80% | $5,000 | $500 | $26.48 |

| 80% | $5,000 | $300 | $32.22 |

| 80% | $10,000 | $1,000 | $18.94 |

| 80% | $10,000 | $500 | $30.72 |

| 80% | $10,000 | $300 | $37.38 |

| 80% | $30,000 | $1,000 | $23.19 |

| 80% | $30,000 | $500 | $37.61 |

| 80% | $30,000 | $300 | $45.75 |

| Reimbursement % | Annual Reimbursement Limit | Annual Deductible | Monthly Premium |

| 90% | $5,000 | $1,000 | $18.15 |

| 90% | $5,000 | $500 | $29.43 |

| 90% | $5,000 | $300 | $35.80 |

| 90% | $10,000 | $1,000 | $21.05 |

| 90% | $10,000 | $500 | $34.13 |

| 90% | $10,000 | $300 | $41.53 |

| 90% | $30,000 | $1,000 | $25.77 |

| 90% | $30,000 | $500 | $41.78 |

| 90% | $30,000 | $300 | $50.84 |

To help you save on your monthly premium, Embrace offers discounts for certain cases. You can receive a 5% military discount, 10% veterinary staff discount, or 15% USAA discount.

-

Waiting Periods

Many pet insurance plans require waiting periods to prevent fraud. These waiting periods are required for all newly enrolled pet and for pets being added to an existing policy – it’s simply a short period of time at the beginning of the policy when coverage is restricted.

In other words, you can’t purchase a plan because your pet is sick and use it immediately. Embrace pet insurance provides coverage for future health issues.

Embrace requires the following waiting periods:

- 48 hours for accidents

- 14 days for illnesses

- 6 months for orthopedic conditions

If you purchase an insurance plan on January 1st, your policy will become effective the following day on January 2nd. On January 4th, your pet’s coverage for accidents begins and coverage for illness starts on January 16th. Orthopedic coverage will start July 1st, unless you follow the Orthopedic Exam and Waiver Process which reduces the waiting period to 14 days.

In addition to these waiting periods, Embrace also requires a vet visit. If your pet hasn’t been seen by a licensed vet within the past 12 months of enrollment, you’ll have to have him seen (at your own expense) within the first 14 days of coverage.

-

Claim Limits

Many pet insurance companies set a limit on the amount you can request reimbursement for per accident or illness. Embrace works a little differently in that they don’t set per-incident limits. Instead, you choose your annual reimbursement limit and reimbursement percentage when you enroll.

The annual limit is simply the maximum amount Embrace will reimburse you each year and the reimbursement percentage is the percentage of each claim they will reimburse after you’ve met your annual deductible. The only claim limit is for dental illnesses which are covered up to $1,000/year.

-

Deductibles

A deductible is the amount you pay for covered services before the plan starts to offer reimbursement – deductibles are on top of your monthly premiums. At Embrace, you can choose from three annual deductible options: $500, $700, or $1,000. This deductible must be met before the plan will start to reimburse your claims and it resets each year.

-

Medical History Review and Pre-Existing Conditions

When you enroll your pet in Embrace pet insurance, the company will perform a medical history review within the first 30 days. You’ll receive a list of possible pre-existing conditions or a note that your pet has none. If you’re concerned about pre-existing or chronic conditions when enrolling, you can request to have your pet’s medical records reviewed early.

If you’re dissatisfied with the results of your pet’s medical records review, you can cancel your policy. The company offers a 30-day money-back guarantee as long as no accident or illness claims have been made. If you’ve made a claim, your refund will be pro-rated based on the unused portion of your policy.

A pre-existing condition is defined by Embrace as:

“Any injury, illness, or irregularity noticed by you or your veterinarian before the end of your waiting period, even if your pet never went to see the veterinarian for it.”

No pet insurance company covers pre-existing conditions, but if your pet has one it won’t stop you from obtaining coverage – you simply won’t be able to file a claim for services related to that condition. What makes Embrace different from other companies like Healthy Paws is that they offer a distinction between curable and incurable pre-existing conditions. The difference is curable conditions may be covered if your pet goes 12 months without symptoms of treatment.

Curable pre-existing conditions include the following:

- Urinary tract infections

- Bladder infections

- Respiratory infections

- Vomiting and diarrhea

- Gastrointestinal disorders

Incurable pre-existing conditions include orthopedic illness and injury opposite the side of a prior injury, allergies, cancer, diabetes, hyperthyroidism, urinary or bladder crystals, and other chronic conditions. Embrace offers limited coverage for bilateral conditions – a condition or disease that affects both sides of the body such as hip dysplasia.

-

Optional Wellness Plans

Because Embrace is an accident and illness policy, the plan doesn’t cover routine veterinary expenses. That being said, they do offer Wellness Rewards, a flexible preventive care plan that reimburses for everyday veterinary, training, and grooming costs. It’s not a separate policy or pet discount plan but gives you rewards for being proactive about your pet’s health.

Choose from the following reimbursement levels:

- $250 allowance per policy year

- $450 allowance per policy year

- $650 allowance per policy year

New pet parents may do best with the $650 option considering puppies and kittens need extra visits their first year for vaccinations and spay/neuter surgery. Older pets who only need annual vaccinations and heartworm preventives may do well with the first option. Either way, you’ll receive a $25 annual award. On top of your additional reimbursement.

-

Pets Covered

Embrace is primarily an insurance company for dogs and cats. Their nose-to-tail plan covers puppies and kittens up to their 15th birthday. After the age of 15, pets are only eligible for Embrace’s accident-only plan. Embrace doesn’t offer coverage for other pets besides cats and dogs.

Embrace Customer Reviews

Before you sign up for an insurance plan, it’s always a good idea to do your research to see what current customers think. Here are some positive reviews and negative reviews from real customers:

Positive Reviews

“Embrace truly exceeded my expectations in handling my recent claim. For context, my dog recently swallowed some raisins and had to stay at an emergency pet clinic for 48 hours while they monitored her for any adverse side effects. The bill was rather expensive and I had assumed that Embrace would likely find some reason to deny the claim… or at least question it. Neither of these things happened! I submitted the claim online and within a reasonable amount of time they approved the claim without any pushback whatsoever. My deposit came shortly after that. I appreciate how quickly they were able to turn everything around and how little hassle they presented in the process. Would definitely recommend them as a pet insurance provider.” – Andrew of San Francisco, CA

“I have had my dog and 2 cats insured through Embrace for several years and up until recently, I have been lucky to not have to submit a claim. Unfortunately, my kitty, Smokey, began losing weight. He was very sick and I was taking him to the Vet and after much testing, they found he had Triaditis and Cancer of the Intestines. Needless to say, it was expensive and had it not been for Embrace, I could not have given my kitty extra time and comfort before I had to send him to the Rainbow Bridge. Embrace made it so easy to submit claim forms for each Vet visit, each test, all the medication poor Smokey was on. They processed the claims efficiently and quickly. They approved everything that was covered under the policy I chose and the checks were in my hands so I could continue to try to help my kitty.” – Joyce of Las Vegas, NV

Negative Reviews

“I signed up with Embrace 2 years ago for both my dogs through my USAA insurance, I figured hey, my trusted USAA trusts them so they should be trustworthy right? BIG WRONG! My prior experience with Embrace Wellness portion was great, easy peasy! And now when I need to use the accidental portion of my coverage, I’m totally being shafted. My dog tore her ACL ON 7/13, we had surgery 8/3. I submitted my claim And jump through hoops playing middle man and satisfying all embrace’s request to get all medical records of the 5 years of my Pomeranian, Daphne’s, life… being military and moving a lot, it’s no easy feat. Apparently, my current vet’s medical records are not detailed enough for Embrace, which my vet’s office has explained to embrace is all they Have/use.” – Alisha of San Antonio, TX

“At the time of application, the company reviewed vet notes for previous 12 months. Those notes reflected one instance of vomiting and two instances of abnormal lab results. The only definitive diagnosis of a specific illness was a possible urinary tract infection. The company implicitly advised it would not cover any future illness that occurred within 12 months of the above findings if any of those findings reappeared in the future, unless it was proven the finding was unrelated to the new illness. It appeared to me that if my pet vomited again within 12 months and if that turned out to be a symptom of any illness whatsoever, there would be no coverage.” – Kenneth of Sarasota, FL

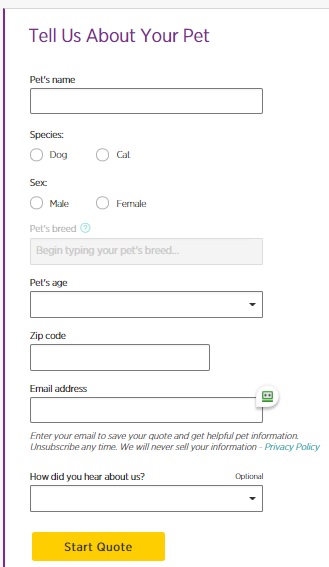

How Do You Sign Up?

To sign up for Embrace pet insurance, you first need to provide some information about your pet and request a quote.

Here’s the information you’ll need to provide:

- Your pet’s name

- Your pet’s species (dog or cat)

- Your pet’s sex (male or female)

- Your pet’s breed

- Your pet’s age

- Your zip code and email address

Once you’ve filled in the necessary information you’ll be asked to customize your policy options. Choose the annual reimbursement limit, annual deductible, and reimbursement percentages that meet your needs. As you click through the different combinations, you’ll see your monthly premium change. You can also choose to add Wellness Rewards or skip that coverage.

Next, review your plan or add another pet then fill in your billing information. If you qualify for any discounts you’ll provide that information at this point before seeing your final price.

Is Embrace Pet Insurance Worth It?

Signing up for Embrace pet insurance is very easy and their plan is quite comprehensive. Not only do they offer three different levels of reimbursement, but you can choose from five options in your deductible and annual reimbursement limit. This makes it easy to customize your plan’s policy terms.

When it comes to the question of whether Embrace is worth it, it really varies from one situation to another. If you’re looking to save money on things like your dog’s first wellness exam or his annual checkup (in other words, preventative care), you may not get your monthly premium back in wellness rewards. If you’re looking for coverage that gives you peace of mind in the event of an unexpected accident or illness, however, Embrace could be a good option to consider.

Embrace isn’t necessarily the best pet insurance on the market, but that’s only because different pet owners have different needs – one plan can’t possible meet all needs. If you’re looking for a plan with flexibility in pricing and coverage, however, Embrace is one to think about.

Click Here to Get A Quote on Embrace Pet Insurance

Frequently Asked Questions

Who owns Embrace pet insurance?

Embrace was started in 2003 when it won the Wharton Business Plan Competition as a pet insurance concept. The company partnered with American Modern Insurance Group in 2012 and AMI continues to serve as the underwriter for Embrace.

How to cancel Embrace pet insurance?

As a policyholder, you can change your coverage at any time by logging into your MyEmbrace account online. You’ll have the ability to increase your deductible, decrease your annual maximum, or decrease your reimbursement percentage – these three options will lower your premium. If you want to cancel your policy entirely, you can email your cancellation request or contact customer service directly.

Does Embrace pet insurance cover cremation?

No, Embrace doesn’t offer coverage for cremation or burial under their comprehensive accident and illness plan. They do, however, offer limited reimbursement under their Wellness Rewards program.

Does Embrace pet insurance cover hip dysplasia?

Yes, Embrace covered hip dysplasia as long as it isn’t a pre-existing condition. If your dog passes the 6-month waiting period or you complete the orthopedic report card, your dog’s condition should be covered under the breed-specific and congenital conditions coverage.

Does Embrace pet insurance cover allergy testing?

Yes, Embrace offers diagnostic testing for new illnesses including allergies. If your dog already has been diagnosed with allergies prior to enrollment, however, it may not be covered.

Does Embrace pet insurance cover blood work?

Yes, Embrace covers diagnostic testing related to covered accidents and illness including things like bloodwork, x-rays, and fecal exams.

Does Embrace pet insurance cover dental?

Yes, Embrace covers dental illnesses such as gingivitis, periodontal disease, root canals, oral masses, extractions, and more up to a maximum payout of $1,000 per year. Routine dental cleanings may not be covered.

Does Embrace pet insurance cover emergency visits?

Yes, Embrace covers emergency visits. Accident and illness coverage includes any emergency veterinary hospital, including after-hours treatment centers.

Does Embrace pet insurance cover neutering?

No, Embrace considers spaying and neutering a routine veterinary expense and doesn’t cover it under their comprehensive accident and illness plan. They do, however, offer limited reimbursement under their Wellness Rewards program.

Does Embrace pet insurance cover medication?

Yes, Embrace offers coverage for prescription medications including pain relievers, antibiotics, and insulin for covered conditions. Nutritional supplements are not covered by may be eligible for limited reimbursement through the Wellness Rewards program.

Does Embrace pet insurance cover prescription food?

No, Embrace doesn’t offer coverage for prescription diet food under their comprehensive accident and illness plan. They do, however, offer limited reimbursement under their Wellness Rewards program.